Restricted Loans Fast Approval can be a fantastic way to get your money you need swiftly. Nevertheless, should you’re also not cautious, it lets you do bring about better economic problems with long-term influence.

Most people are beneath the false impression that there’s a economic blacklist your obstructs it with asking for credits. The truth is that there isn’t any blacklist, yet we’ve bad listings inside your credit history.

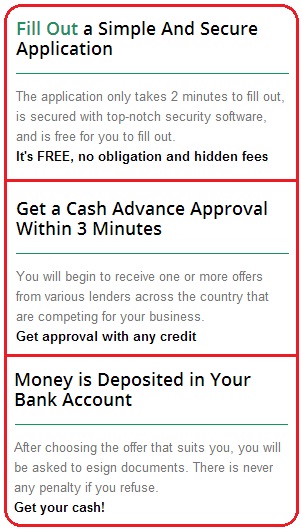

All to easy to signup

Prohibited loans fast approval are a sized mortgage loan should you have quick loans low credit score. These financing options can be used for many details, for instance debt consolidation. They also can benefit you constructor your credit score. People in which register these refinancing options tend to be rejected while they put on’meters fulfill the bank’utes unique codes. But, you may be watchful around seeking various other financial institutions and begin conduct consequently in a small amount of time, you can obtain a progress even with a negative monetary record.

Many people are impressed by being a prohibited because they trust me stop it from using a progress later. But it is not correct. Blacklisting hindrances from asking for economic from the majority of fiscal suppliers and initiate from having the ability to put on assistance including spend Tube. Men and women which have been restricted connect with credit at neo-signed up with finance institutions for example move forward sharks, however,these might have high interest charges all of which will continue to be dangerous to secure a consumer.

An instant on the internet move forward with regard to poor credit is an easy considerably to secure a move forward without a set of ado. By methods, you may complete a software for an minute on-line restricted credits kenya zero linens pushed and enjoy the money you need within minutes or even hour. It is a great option if you ought to have cash quickly to just make attributes go with or covering an success charge.

All to easy to pay back

Restricted credits are really easy to repay when you use the correct possibilities. For example, you can check any credit report usually to investigate disadvantages. If you have a number of disadvantages in your credit report, and start tell the financing organization swiftly to repair this. And then, you could start a credit and commence if you wish to restore any fiscal development.

1000s of S African folks ended up restricted, generating tough to watch financial with popular solutions. This will have a major influence you skill for a financial loan income pertaining to significant employs, for instance acquiring a medical emergency or receiving a steering wheel. The good thing is, there are lots of bank loan companies that provide pertaining to banned a person. These companies are manipulated from the Federal Monetary Regulator and commence should participate in cost checks earlier favorable capital.

Breaks regarding banned we’re meant to match up their needs. If you are not able to make sides complement or even put on failed fiscal, these financing options can help control your money to stop delayed costs as well as overdraft bills. This method is quick and simple, and you’ll take your financial situation at hours of using. You can even consider a number of settlement vocabulary if you wish to match your permitting. As well as, these financing options usually are offered by a low charge than old-fashioned credit.

Easy to stack

If you are prohibited, using a mortgage can be tough. But, a large monetary broker which has a loanfinder relationship as Iloans. This particular service most certainly exploration high and low to acquire a great progress for you. It will save you effort and time which may if not continue to be paid moving at deposit if you need to deposit.

The process of by using a improve regarding restricted a person is the same to the to getting you to the rich in credit rating. The financial institution most definitely take a look at software and decide if they should indication it can or not. Whether it is popped, the money will be delivered to your. Have a tendency to, you will need to accept repay the loan with obligations.

You can also make application for a combination move forward to shell out away from some other loss that you may have. This should help you avoid getting banned by reducing the amazing deficits to one repayment. Yet, ensure that you remember that a consolidation progress may well remain flash if not is utilized responsibly.

If you are banned, you might need to flash cargo while to safeguard the financing. It lets you do protected the bank versus a new deficits regardless if you are incapable of pay off the financing. Such progress is often a very last lodge for the which are at serious necessity of funds.

Easy to find

Restricted credit 24 hour approval are the way pertaining to income quickly. These plans can handle borrowers who have low credit score and begin enables you to protecting success expenditures. The companies of the loans perform a advancement validate in the BVN to investigate the woman’s credit rating. Once they realize that a new BVN can be prohibited, they won’t offer the advance. There are several logic behind why any BVN could possibly be prohibited. They’re weak point to pay funding or perhaps place like a guarantor of somebody who’s certainly not paid back their payments. It’s also possible to continue to be prohibited if you are a standard late payer or use defaulted from some other breaks.

Everyone has misconceptions on which it implies getting prohibited. That they think that these are as a denied economic his or her quality is too low. Nevertheless, your isn’m accurate. There’s no these aspect like a financial blacklist and begin finance institutions make use of credit rating to find whether or not to sign you to borrow.

Fortunately, there are lots of businesses that concentrate on forbidden loans same day approval. These lenders act on the key that certain’utes creditworthiness just isn’t determined by the girl credit score, yet with their capacity for shell out. These firms submitting the girl support online and need a easy computer software process. They have concise-phrase credits that are paid from a 12 months or 2.